OTP Bank Romania announces the financial results for 2023:

- OTP Bank Plc concluded at the beginning of 2024 a share sale and purchase agreement to sell its directly and indirectly owned 100% shareholding in OTP Bank Romania. The transaction also includes OTP Leasing Romania and OTP Asset Management subsidiaries.

- 2023 report shows great consolidated financial results, with growing profitability and increasing incomes.

- The operating profit reached 270 million RON, increasing by 25% compared to 2022.

- Net interest income increased by 4% y-o-y, to a total of 698 million RON.

- Performing loans volume slightly decreased by 3% mainly due to decreased demand of mortgage loans, influenced by high interest rates.

- Deposits increased by 16% y-o-y, above the market increase, sustained by retail and corporate segments.

OTP Group announces the financial results for 2023. According to the report published in Budapest, which presents the consolidated results adjusted in accordance with the Group´s standards, OTP Bank Romania recorded a consolidated net profit of 262 million RON in 2023, seven times higher than the amount of 2022.

Operating profit in 2023 reached RON 270 million, up 25% higher than in 2022, as a result of a 13% increase in total income, while net interest income grew by 4% y-o-y, and net fees and commissions increased by 8%, following an increase in card commissions. Operating expenses grew by 8% y-o-y, mainly triggered by wage hikes and other expenses impacted by the high inflation, which stood above double digit until August. The cost to income ratio improved to 69.4% in 2023 (-2.8 pps y-o-y). The active customer base also grew by 15% y-o-y, reflecting customer trust and loyalty.

„I am proud to say that OTP Bank Romania not only navigated the challenges with resilience, but during the sale process remained steadfast in its commitment to excellence, ensuring the continuity of its successful operations. 2023 marked an important milestone for us, as we proudly achieved a record profit, a commitment to the dedication and competence of our team. Furthermore, we are pleased to report a remarkable 15% increase in our active customer base, reflecting the growing confidence and satisfaction of our valued customers. These results underscore our relentless focus on delivering exceptional financial services and strengthening client relationships.", said Gyula Fatér, CEO OTP Bank Romania.

The net interest income grew by 4%, to a total of RON 698 million, with an annual dynamic that benefited from stable loan volumes and the repricing of outstanding loan volumes in the higher interest rate environment. Nevertheless, the net interest income indicator and other income dynamics were influenced by the change in the accounting of result on FX swap deals, although this reclassification was neutral on profits.

Total risk cost amounted to +RON 38 million, mainly driven by the credit risk cost in the second quarter of the year, which stemmed from the sale of the Romanian factoring company’s non-performing loan portfolio.

Performing loan volumes decreased by 3% y-o-y at the end of 2023, while q-o-q volumes were stable. This was due to a 12% drop in mortgage loans, caused by the rising mortgage rates, and a 4% decline in consumer loans, which was only partly offset by the 3% increase in corporate loans and a 9% growth in leasing volumes. Following the decline in interest rates towards the end of the year, mortgage loan placements tripled q-o-q in the fourth quarter.

FX-adjusted deposit volumes increased by 16% in 2023. The largest contribution came from retail deposits, which grew by 17%, while corporate deposits increased by 13%. A multi-year improvement drove the net loan to deposit ratio below 100% by the end of the year (-19 pps y-o-y). As a result, the volume of liabilities to credit institutions fell by 41% y-o-y.

According to local reporting standards, the bank´s assets reached RON 19.8 billion, a stable level compared to the previous year.

The bank's capital adequacy ratio reached the level of 23.88% (+138 bps y-o-y) on the background of own funds increase.

In 2023, OTP Group has registered an adjusted after-tax profit of HUF 1,009 billion (RON 13,044 million) while the consolidated accounting loss/profit was HUF 991 billion (RON 12,810 million).

Profit contribution of OTP Core – Hungary (HUF 303 billion / RON 3,918 million), DSK Bank in Bulgaria (HUF 202 billion / RON 2,612 million), the Slovenian operation (HUF 129 billion / RON 1,665 million), the Russian (HUF 96 billion / RON 1,237 million), the Serbian (HUF 68 billion / RON 880 million), the Croatian (HUF 54 billion, RON 698 million), the Ukrainian (HUF 45 billion / RON 584 million), the Montenegro operation (HUF 22 billion / RON 282 million), the Albanian subsidiary (HUF 15 billion / RON 194 million), Moldavian subsidiary (HUF 15 billion / RON 190 million) and Uzbekistan subsidiary (HUF -22 billion / RON -283 million).

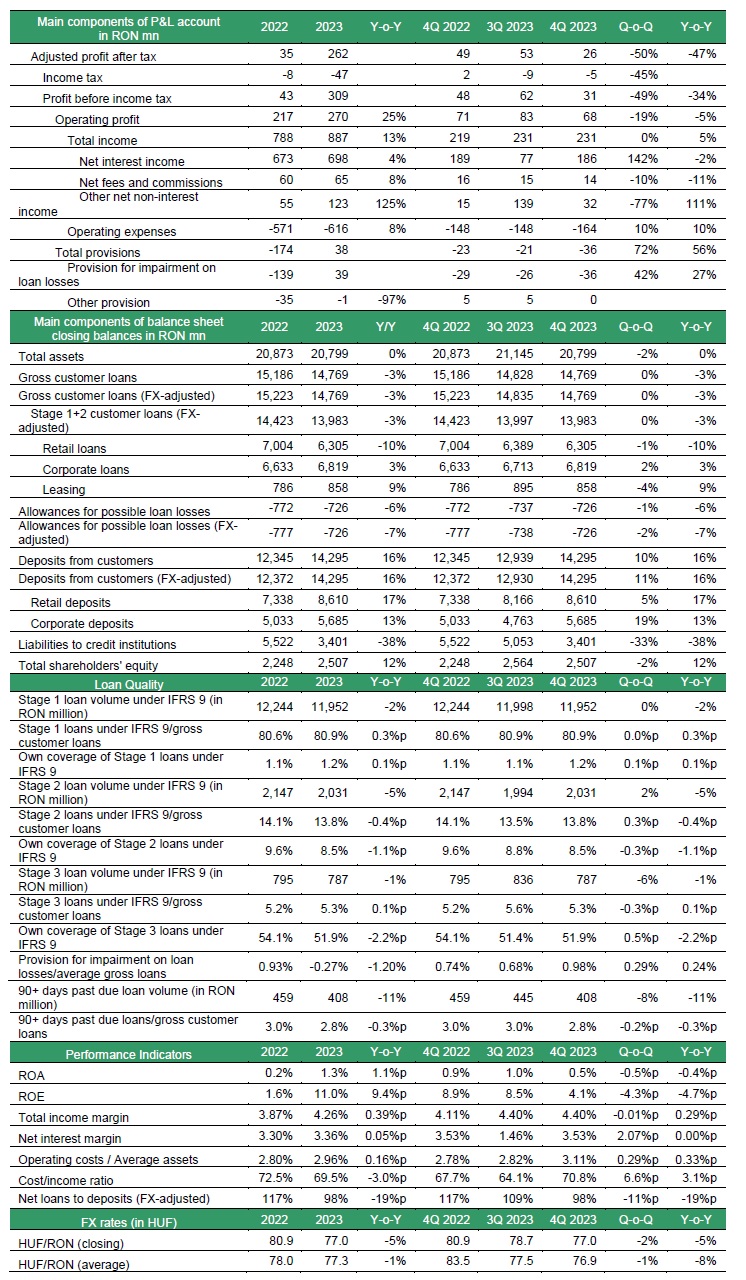

The full results of OTP Bank Romania are presented in the table below:

The full report published by OTP Bank Plc. is available here.

About OTP Bank Romania

OTP Bank Romania is the subsidiary of OTP Group, a universal bank with a very good presence in Central and Eastern Europe, which offers complete financial solutions, being active in both the retail and corporate segments. After four years of constant and considerable growth in all business lines, OTP Bank Romania is moving towards a process of consolidating its portfolio and operations. With a team that embraces change and capitalizes on its potential, OTP Bank Romania builds a culture of trust at every level of the organization. In Romania, the members of the OTP Group are OTP Bank Romania, OTP Consulting, OTP Leasing, OTP Asset Management, OTP Factoring, OTP Advisors, and the OTP Bank Romania Foundation.

About OTP Group

OTP Group is one of the fastest growing and one of the leading banking groups in the Central and Eastern European region, with outstanding profitability and a stable capital and liquidity position. With more than 41,000 employees in now 12 countries of the CEE and Central Asian region, the Group provides universal financial services to more than 17.5 million customers. As the most active consolidator in the banking sector of the Central and Eastern European region, the Group has successfully acquired and integrated 23 banks since the early 2000s. Currently, the Bank is a market leader in Hungary, Bulgaria, Serbia, Montenegro, and in Slovenia. OTP Group is headquartered in Hungary and has a diversified and transparent ownership structure. The Banking Group has been listed on the Budapest Stock Exchange since 1995.