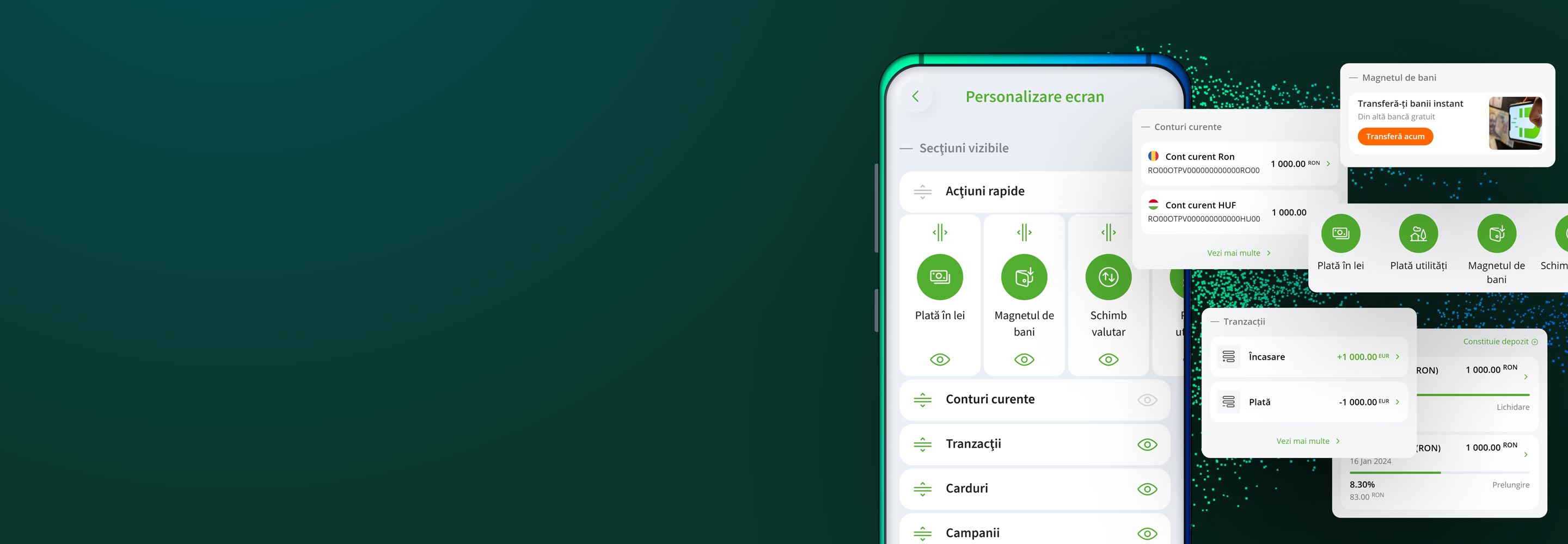

Dashboard screen that you can customize according to your needs and preferences

Dedicated area for Quick Actions with easy access to your favorite features

Widgets with key information about the your products

Watch the tutorial and find out how you can do all this

What advantages do you have with OTPdirekt - SmartBank?

You benefit from an extended working schedule than the bank's counters;

Fees are lower up to 50% than bank counters for SmartBank operations;

- You can create / view / liquidate deposits in lei or EUR and you benefit from an interest bonus of 0.20%, 0.10% respectively;

You pay for telephone and utility bills, transfers between your own accounts (in lei or in foreign currency) and you can make payments in lei to beneficiaries with accounts with any other bank in Romania and in foreign currency to those with accounts with OTP Bank;

You can quickly find your nearest ATM or Territorial Unit;

You have many possibilities for online bank transfers via the Money Magnet option;

You can make currency exchanges;

You can view your account balance and transaction history;

You are informed about the exchange rate practiced by OTP Bank;

You can log in to your Application using fingerprint scanning or FaceID, (available for iPhone X);

You can change your card trasaction limits whenever you like and turn on / off Internet payments.

How to access OTPdirekt - SmartBank?

Download the Application

Access the App

for free for Android and iOS.

Contact us

Fill in the form

and our colleagues will contact you shortly.

Similar products recommended

Frequently asked questions

How can I access OTPdirekt - Internet Banking and SmartBank?

After signing an OTPdirekt contract beforehand in the branch, access is made as follows:

- OTPdirekt - Internet Banking can be accessed on the Internet at www.otpdirekt.ro dedicated page or by visiting the bank's website www.otpbank.ro, choosing one of the two methods of identification „with card” or „without card”. The „card” identification method involves entering the last 10 digits of the bank card and the 3-digit access code. The „no card” identification method involves entering the client code, user, and 3-digit access code. After entering the data from the first identification step, you can enter the digits generated by the physical token or received via SMS, in the case of virtual token identification, to access all of your accounts and make transactions.

- OTPdirekt - SmartBank can be accessed directly from the available Android / iOS App or by accessing the m.otpbank.ro mobile site, choosing one of the two „card” or „no card” identification methods. The „card” identification method involves entering the last 10 digits of the bank card and the 3-digit access code. The „no card” identification method involves entering the client code, user, and 3-digit access code. After entering the data from the first identification step, you can enter the digits generated by the physical token or received via SMS, in the case of virtual token identification, to access all of your accounts and make transactions.

Who can benefit from the OTPdirekt service?

OTPdirekt - Contact Center, Internet Banking, SmartBank and Push notifications / SMS Alerts are available to any client, individual, legal person or authorized person who has a current account with OTP Bank and has concluded an OTPdirekt contract.

Can I change the access code?

The access code can be changed as often as necessary. You can also use this option if you think the current code no longer offers the desired security level. At first use it is mandatory to change the access code from its default value so that it is only known by you. Also, to use OTPdirekt - Internet Banking safely, the Application will ask you to change the access code once every 3 months.

Can I make payments / transfers both in lei and in foreign currency?

Yes, through OTPdirekt - Internet Banking and Contact Center you have access to payments and transfers both in LEI and in currency between your own accounts, as well as to other OTP Bank clients or other banks clients (domestic and foreign). OTPdirekt - SmartBank also offers you the possibility to make intrabanking and interbanking payments and transfers in lei, as well as intrabanking in currency.

Is access to this service secure? What security standards are used?

Yes, the OTPdirekt service is secure. The security certificate is provided by VeriSign (http://www.verisign.com), world leader in Internet security. Also, communication between your workstation and your bank is performed on an encrypted channel using the 128-bit SSL standard.

How do I pay suppliers' invoices through OTPdirekt?

Payment of bills to utility providers is possible, and the menu that will be accessed from Internet Banking is Operations - Utility Payments. They can also be accessed via SmartBank using the „Payments” menu, the „Utilities” section or by calling the Contact Center.

How can I use OTPdirekt - Internet Banking or SmartBank from abroad?

This service is available from anywhere, both in the country and abroad, via the www.otpbank.ro website, through native Android or iOS Apps.

How can I make a transaction if I do not have access to the Internet?

If Internet access is temporarily unavailable, you can do the same range of transactions based on the same subscription and the same identification process that you make on the website through our Contact Center channel (only for OTPdirekt clients, type A and bank card). Your call will be taken over by a specialist operator who will perform the operations based on your consent. The available telephone numbers for contacting the Contact Center are:

0800 88 22 88 (free of charge, available from any fixed or mobile network in Romania)

021/308.57.10 (also available from abroad).

How can I become an OTPdirekt user?

In order to become an OTPdirekt subscriber, it is necessary to:

- be an OTP Bank client,

- sign an OTPdirekt contract.

The form is available in all OTP Bank branches in the country.

Are there transaction limits for OTPdirekt?

Depending on the chosen OTPdirekt contract type, there may be transaction limits of LEI 50.000 or EUR 10.000 per transaction, or there may be no transaction limits.

What should I do if I have locked my OTPdirekt access code?

If access was locked by entering the 3-digit access code incorrectly, please contact us at 0800 88 22 88 (free of charge from any fixed or mobile network in Romania) or at +4021 308 57 10 (Monday to Friday 8:30 - 21:00, also from abroad). In addition, in the Internet Banking interface, the client benefits from the ability to set security questions so that unlocking of the access code can also be made online.

What are the technical requirements in order to use OTPdirekt?

A necessary condition for running the Internet Banking Application is to enable JavaScript in your browser. To verify / enable this option, make the settings according to the used browser:

- Internet Explorer – Tools/Internet options/Security (tab)/ Custom level/ Scripting – Active/Scripting: Enable.

- Mozilla and Netscape – Edit/Preferences/Advanced/Scripts&Plug-ins/Enable JavaScript for Navigator.

- Opera - Tools / Preferences / Multimedia / Enable JavaScript.

For SmartBank service, the phone's operating system needs at least Android 5.1 or iOS 4.

Communication between your workstation and your bank is made on an encrypted channel using the 128-bit SSL standard.

The browsers that are certified by the Internet Banking Application are:

- Internet Explorer 6.0

- Mozilla 1.7

- Netscape 7.0

- Opera 7.0

The optimal screen resolution is at least 1024 x 768 pixels with a colour depth of at least 16 bits.

Can I make OTPdirekt transactions even on the weekend?

You can use the OTPdirekt service to make transactions via Internet Banking or SmartBank even on weekends, processing taking place on the first bank business day. For more details, see the „Accepting programme and maximum time line for executing operations” for Internet Banking by going to the „Useful Tools” section after login.

How to use OTPdirekt?

Learn more about how simple OTPdirekt platform works! Watch the video tutorials or call us at 0800 88 22 88 (free of charge from any fixed or mobile network in Romania) or at +4021 308 57 10 (also available from abroad).

How do I find out my account balance?

If you have a debit card attached to that account, your balance can be found free of charge either on the www.otpbank.ro website or by calling 0800 88 22 88 (free of charge from any fixed or mobile network in Romania) +4021 308 57 10 (also available from abroad), being necessary the last 10 digits of the card number and a 3-digit access code. You can also activate your Push Notifications / SMS Alerts service and you will always be aware of your account status.

How can I obtain the supporting documents for payments made through OTPdirekt?

In order to obtain the supporting document following operations made through the OTPdirekt channels, it is possible to verify the transactions in the account statement available in OTPdirekt - Internet Banking, the Statements and Proof of Payments menu. For payments in foreign currency, there is a requirement for the client to bring the Foreign Payment Order / Payment Request within 10 days, in duplicate. One of the copies, with the signature of the bank employee and the bank stamp, remains with the client and the other with the branch.

Do I need to install a software to access my accounts?

In order to use it, you do not need to install a program on your personal computer. It is enough to enter OTP Bank's website, www.otpbank.ro, and follow the identification steps. The physical token device is used by pressing the button on its front, automatically generating the related unique code; in the case of the virtual token, the unique code is transmitted by SMS to the mobile phone number specified when signing the OTPdirekt contract.

What accounts can be accessed through OTPdirekt?

With this service you have access to three channels of use: Contact Center, Internet Banking, and SmartBank. Through Contact Center and Internet Banking, you will have access to all your current accounts in lei and foreign currency, savings accounts, deposits, related credit card accounts, information regarding ongoing loans with OTP Bank. With SmartBank, you can access your current accounts in lei or foreign currency, deposits, or information regarding savings account balance.

How do I know if my payment has been made?

To verify if the payment has been made, on the main screen, if that payment is one of the last 10 transactions made, or in the Accounts - Operations History menu.

How can you pay your telephone bills?

Is the due date of the telephone bill approaching and the time is too short to go pay it? Everything is simpler when you can rely on a trust service. All you need to do is access the OTPdirekt - Internet Banking App Operations menu. Choose Domestic Payments / Transfers and from the drop-down list of Choose beneficiary select Payment Orange Romania Communications S.A.

Fill in the fields as follows:

Amount: The amount to pay on the invoice;

Payment order number: The number that the payment order has been allocated to you for the payment of the invoice;

First name and last name of the invoice holder: First name and last name of Orange Romania Communications S.A. subscriber for which the invoice was issued;

Invoice telephone number: Invoice Holder's telephone number (preceded by the prefix);

Invoicing code (Subscriber code): Invoice code entered on invoice.

Object of payment:

- If the payment is related to the current invoice, then select the option Invoice;

- If the payment is the installation fee for the service, then select the Install fee option;

- If the payment is due to the termination of the contract with Orange Romania Communications S.A., then select the Finall account option;

- If you wish to make a payment to Orange Romania Communications S.A. before issue of the current invoice, then select the Prepayment option;

Due date: Due date entered on invoice.

What is the payment schedule and where can it be downloaded?

The payment schedule provides detailed information about the amount of the fees, the rescheduled fees, the rescheduled interest due to the bank according to the loan contract. This information can be found in the document generated by pressing the Generate Payment Schedule button. Downloading the Payment Schedule can only be done from OTPdirekt - Internet Banking.

Useful information, regulations

- OTPdirekt terms and conditions Type A for Individuals

- OTPdirekt terms and conditions Type B for Individuals

- Terms and conditions for Current Account, Debit Card and OTPdirekt framework agreements

- Taxes and Fees

- Accepting programme and maximum time line for executing operations

- Instructions for using digipass (pdf, 988.68 KB)

- List of countries for which the bank requests justifying documents in order to process payments